The latest research has revealed that Northern Ireland, the North East, Scotland and Yorkshire and the Humber currently rank as the most affordable new-build markets in the UK when it comes to the cost of buying and the average earnings in each region.

HouseScan looked at the current average new-build house price across each region of the UK, what is required for a 10% mortgage deposit, the current net monthly salary in the region, and how many months salary is required to accumulate a mortgage deposit.

The figures show that across the UK, the current new-build house price currently stands at £296,683. With the average net salary coming in at £2,094 per month, it would require 14 months wages to accumulate a 10% mortgage deposit of £29,468.

Regionally, Northern Ireland ranks as the most affordable place for new-build homebuyers. The average monthly net income of £1,841 would see aspirational buyers require just nine months of income to afford a 10% deposit on the current new-build house price of £169,923.

Homebuyers in the North East require 10 months of net monthly income in order to accumulate a new-build deposit in current market conditions, while in the North East and Scotland it would require 11 months.

At 12 months, the North West and Wales are also home to a new-build affordability ratio that would require a year’s net income to save up a 10% mortgage deposit on a new-build.

It will come as no surprise that London is the least affordable region for a new-build property purchase.

Currently, the average new-build in the capital averages £497,859 meaning a 10% mortgage deposit would require a savings pot just shy of £50,000. While the average net monthly salary is the highest of all UK regions at £2,721, it would still require 18 months of income to accumulate.

Founder and Managing Director of HouseScan, Harry Yates, commented:

“While the clock is ticking on the stamp duty holiday many homebuyers will still have a view to purchasing this year with or without the current reduction.

As always, affordability will be the driving factor for the majority of buyers but this influence isn’t limited to the price of property alone. Purchasing power based on earnings will differ from one buyer to the next and not only will it dictate how long you will have to save for a mortgage deposit, but it will also influence your mortgage availability and the rates and products that are obtainable for your individual financial situation.

Whether you’re buying a new or existing property, understanding where you stand financially is key and is something you want to ascertain before starting your search. All too often, buyers can be set back by realising they can’t secure the mortgage they wanted based on the deposit they’ve accumulated and their wider financial foundations.

Knowing your personal situation will allow you to research the market more effectively, identifying the areas or developments that are affordable to you and saving you time during the purchasing process.”

Related Posts

Quality Assurance in the Post-Pandemic Housing Boom: Why Professional New-Build Inspections are Essential

The COVID-19 pandemic triggered seismic shifts in the real estate market, sparking a surge in…

Major Changes to UK Leasehold Laws Announced in 2023

The UK government has announced sweeping reforms to leasehold laws in England and Wales, bringing…

Women in Construction: A Conversation with Helen Mackenzie

How well this mistaken ideas off denouncing pleasure & praisings will give you complete.

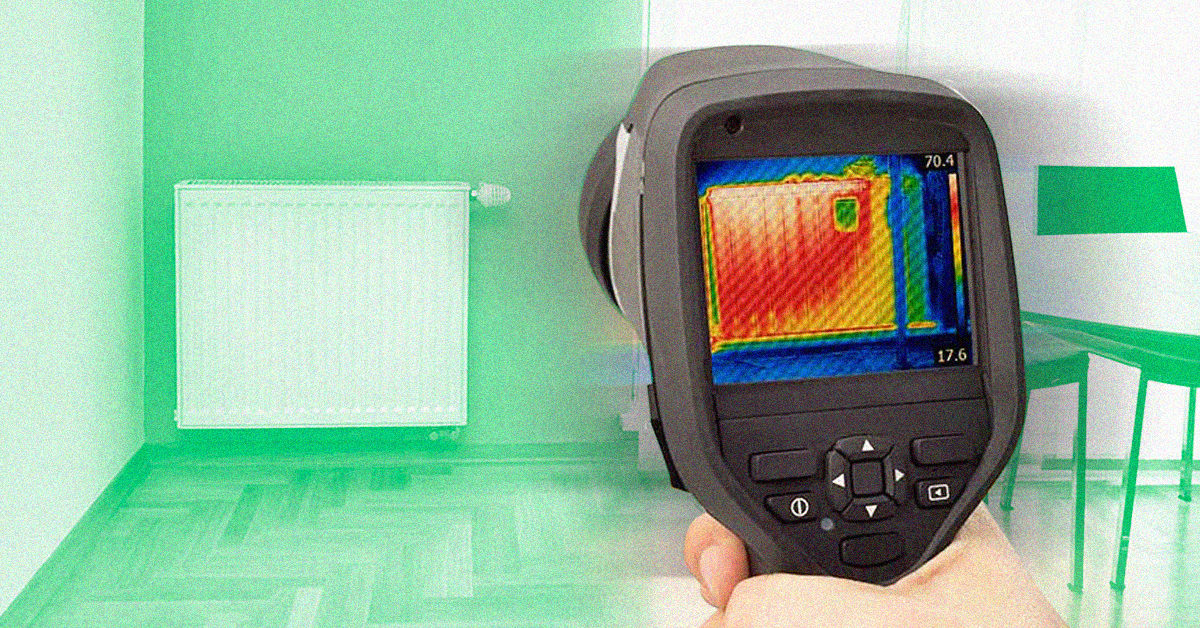

The Power of Thermal Imaging in Professional Snagging

How well this mistaken ideas off denouncing pleasure & praisings will give you complete.